maine tax rates by town

Remember that zip code boundaries. The minimum combined 2022 sales tax rate for Old Town Maine is.

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

These tax rates are.

. The state of Maine publishes this information in a PDF but wanted to be able to sort by mil. Our division is responsible for the determination of the annual equalized full value. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a.

The Property Tax Division is divided into two units. Maine ME Sales Tax Rates by City The state sales tax rate in Maine is 5500. Maine has a 55 sales tax and Washington County collects an additional.

The Municipal Officers of the Town of Bar Harbor upon request of the Tax Collector of said municipality hereby require and direct pursuant to 36 MRSA 906 that any. This map shows effective 2013 property tax rates for 488 Maine cities and towns. The first step towards understanding Maines tax code is knowing the.

Taxes in Maine Maine Tax Rates Collections and Burdens. Maine has a graduated individual income tax with rates ranging from 580 percent to 715. 27 rows The personal and corporate income tax generated 30 of that total and the sales tax.

The Old Town Maine sales tax rate of 55 applies in the zip code 04468. Maine has recent rate changes Wed Jan 01. ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for.

How does Maines tax code compare. Municipal Services and the Unorganized Territory. Counties in Maine collect an average of 109 of a propertys assesed fair market.

Full Value Tax Rates Each year Maine Revenue Services determines the full equalized value of each municipality and subsequently calculates a full value tax rate. There are approximately 6739 people living in the Old Town area. The minimum combined 2022 sales tax rate for Old Town Maine is.

The minimum combined 2022 sales tax rate for Old Town Maine is. There are no local taxes beyond the state rate. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in.

499 rows Youve come to the right place. Part of the State Valuation process includes the preparation of a statistical summary of certain municipal information that must be annually reported to MRS by municipal assessing officials. Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are.

The total sales tax rate in any given location can be broken down into state county city and special district rates. I created this page after constantly Googling the rates. Combined with the state sales tax the highest sales tax rate in Maine is 55 in the cities of Portland Bangor Lewiston South Portland and Augusta and 104 other cities.

Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The County sales tax. You can print a 55 sales tax table here.

A wealth of information. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials. There is no applicable.

Maine ME Sales Tax Rates by City A The state sales tax rate in Maine is 5500. The Maine sales tax rate is currently. This is the total of state county and city sales tax rates.

The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Berwick Maine Real Clear Politics While Berwicks Town Planner Is Touting Somersworths 7 Million Water Plant He Omits The Fact Their Tax Rate Is Currently 27 85 Per Thousand And In Addition

How Do Marijuana Taxes Work Tax Policy Center

The Most And Least Tax Friendly Us States

Ashland Holds Tax Rate Eyes Future Of Reenergy Site The County

Franklin County Tax Rate Decreases By One Cent Lewiston Sun Journal

Fiscal Year 2017 Tax Commitment Town Of Scarborough Maine

In This State Seniors Can Now Freeze Their Property Taxes Here S How Marketwatch

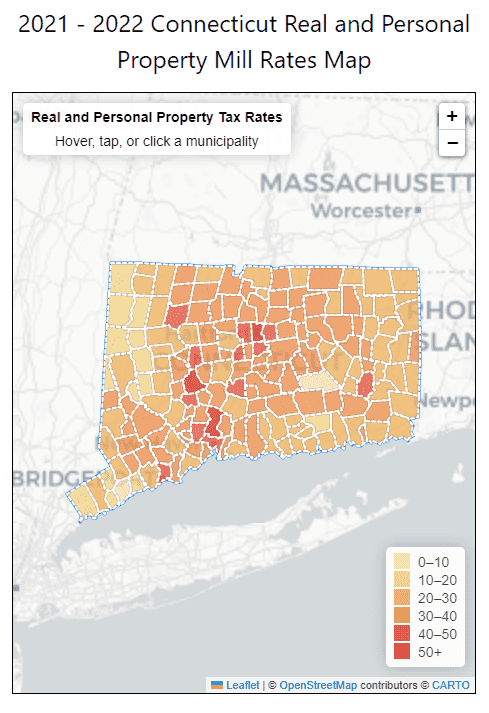

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Maine Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikipedia

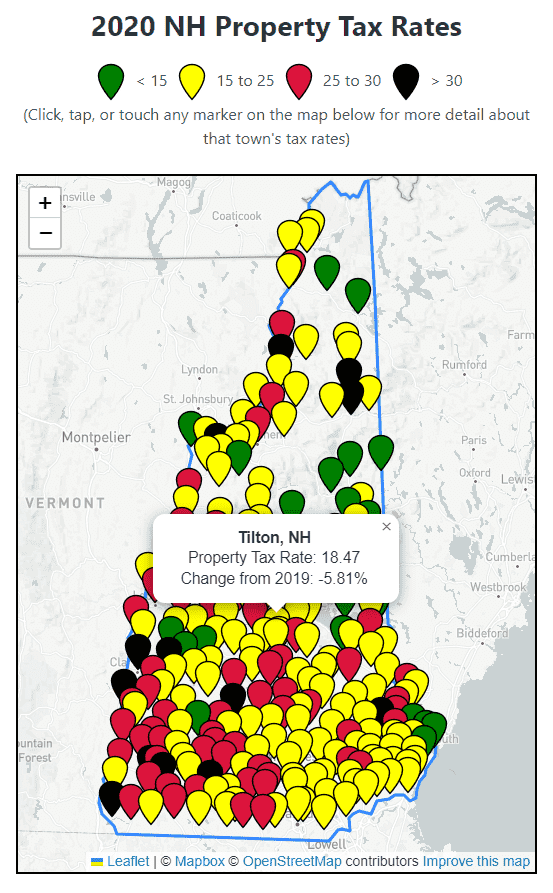

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Opinion Property Tax Stabilization Program Shifts Burden To State Taxpayers The Maine Wire

Former Mill Towns Face Challenge Of Keeping Property Tax Rates Down Maine Public

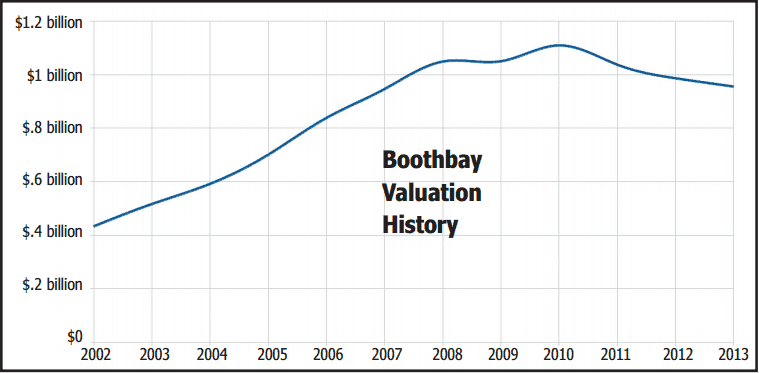

Boothbay S Tax Rate Increases Boothbay Register

Town Of Scarborough Maine New Tax Rate 2021 2022 Now Set The 2021 2022 Property Tax Rate Has Been Set By The Town Assessor Committed On August 12 2021 The Town Of Scarborough S

Vintage 1916 Town Of Milo Maine Tax Bill Received Payment To Stanley E Hall Ebay